Malaysia LHDN E-Invoice - Part 1

IRB targets 4,000 businesses by August 2024 for mandatory adoption of E-Invoice by Malaysia LHDN for annual turnover of RM 100 million! By July 2025, E-Invoice will become obligatory for all businesses, irrespective of their sales threshold.

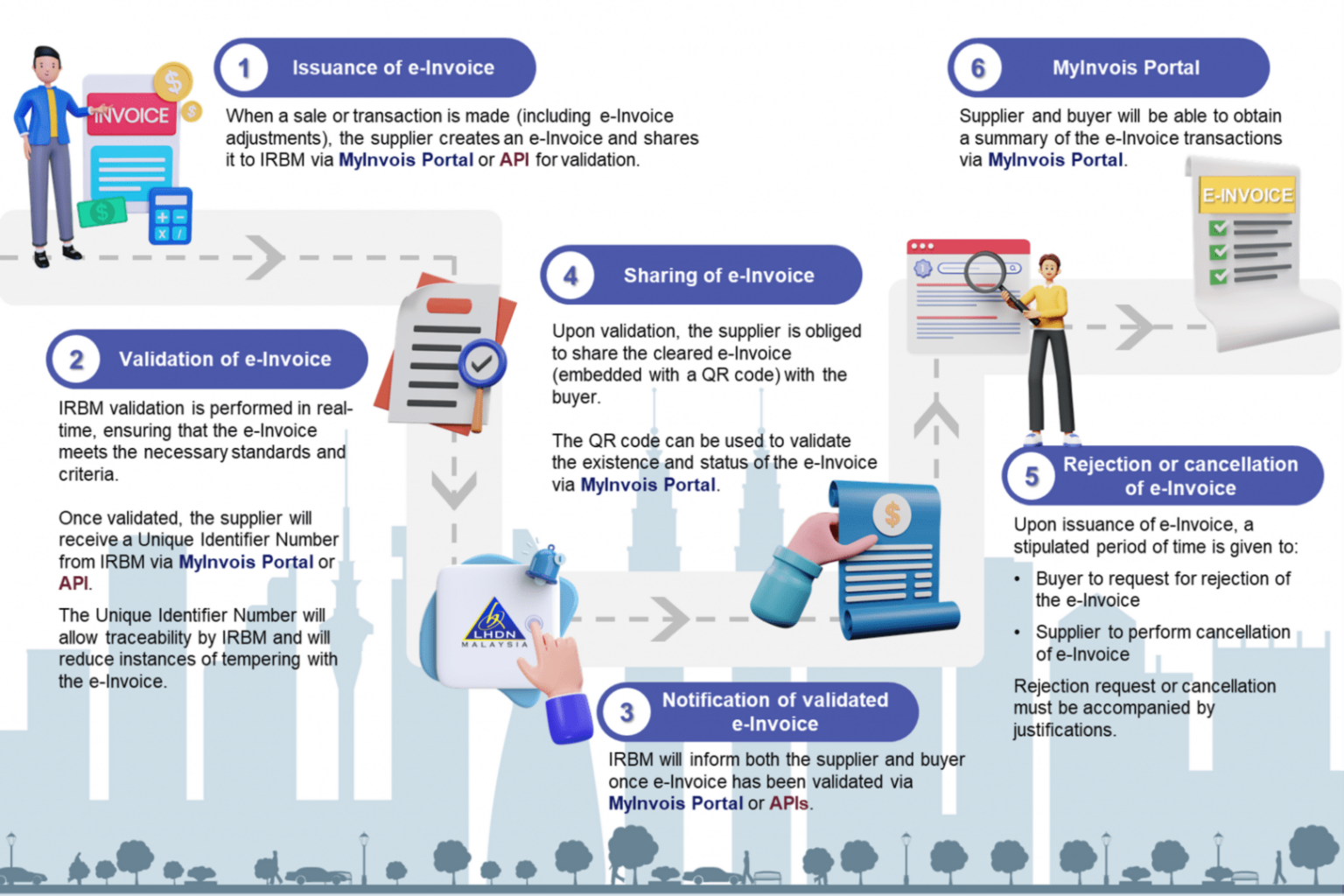

The e-Invoicing system is a significant step forward for the Malaysian government’s digitalization agenda. It is expected to have a positive impact on the economy and help to improve the efficiency of the tax system. The Malaysia LHDN E-Invoicing system is designed to improve the efficiency and transparency of the invoicing process. It will also help to reduce tax evasion and fraud.

Who Are Required To Implement E-Invoice?

What E-Invoice Information Will Be Store In IRBM Database?

General Information:

This includes the invoice number, e-Invoice type, e-Invoice purpose, e-Invoice date (current date)

Supplier & Customer Information:

This includes the supplier and customer’s TIN, name, address, email address, 5 digit MSIC code, MSIC description, website, contact person, and contact number, company registration number/individual myKad number/passport, SST registration number, currency, exchange rate

Item Information:

This includes the description, quantity, UOM, unit price, discount rate, discount amount, tax type, tax code, tax rate, and tax amount, tariff code, subtotal, total excluding tax, total including tax for each item on the invoice

Validation Information:

This includes the IRBM Unique Identifier Number, validation date and time, and validation status of the invoice

Digital Certificates / Signature:

Digital Certificates will be issued to taxpayers to enable them to attach digital signatures to e-Invoices. The digital signature will verify that the submitted e-Invoice data originates from a specific taxpayer

Additional Information (Optional):

This may include payment mode, supplier bank account, payment terms, payment amount, payment date, payment reference number, bill reference number, and other relevant information

What Is TIN Number?

A TIN number in Malaysia is a Tax Identification Number, also known as Nombor Pengenalan Cukai. It is a unique number assigned to individuals and entities registered as taxpayers with the Inland Revenue Board of Malaysia (IRBM). The TIN number is used by the IRBM to identify taxpayers and track their tax records. It is also utilized by the IRBM to monitor taxpayer compliance and detect tax evasion.

The Inland Revenue Board of Malaysia (LHDN) has announced an update to the format of Tax Identification Numbers (TINs) for Malaysian taxpayers. The new format will be effective from January 1, 2023.

The old TIN format was a 12 or 13-digit number, with the first one or two letters indicating the type of taxpayer, such as “SG” for individual residents or “C” for companies. The remaining digits constituted a unique identifier for the taxpayer.

The new TIN format will consist of a 13-digit number. The first two letters will be “IG,” which stands for “Individual taxpayer.” The remaining 11 digits will remain the same as the old TIN number. Here’s how to check your TIN number online.

For more information about the new TIN format, please visit the LHDN website.

SQL Accounting is a user-friendly accounting software that is compatible with Malaysia LHDN E-Invoice. With SQL Accounting, you can easily create and send e-Invoice to your customers. You can also track the status of your e-Invoice and ensure that they are properly validated by the IRBM.

What’s more, if you purchase a new set of SQL Accounting software effective 1st August 2023, you will be entitled to a free E-Invoice module up to 2028! This means that you can save money on the cost of LHDN E-Invoice and get started with E-Invoice right away.

Contact us today to learn more about SQL Accounting and how it can help you comply with E-Invoice regulations.

We also offer a FREE DEMO of SQL Accounting so you can see how our software can benefit your business.

US 16064

US 16064  GB 12668

GB 12668  AU 10034

AU 10034  CA 9761

CA 9761  IE 5784

IE 5784  NZ 3040

NZ 3040  BR 2457

BR 2457  SG 1316

SG 1316