This is despite a stable loan growth recorded in September at 4.4% year-on-year (y-o-y), which was mainly supported by household loans growth. According to an analyst, there needs to be a pick-up in business loans growth, which will then signify improving economic conditions.

“Loans growth for mortgages and auto continue to do well, mainly because these types of loans are collateralised. Therefore, the performance of business loans growth will better reflect the state of the economy - whether it has improved, ” the analyst said.

Bank Negara’s September statistics show that business loans growth have declined to 3.2% y-o-y from 3.7% y-o-y in August, on the back of subdued working capital loans growth.

In comparison, household loans, which comprise mortgages and auto loans, grew 5.2% y-o-y in September from 4.8% y-o-y in August.

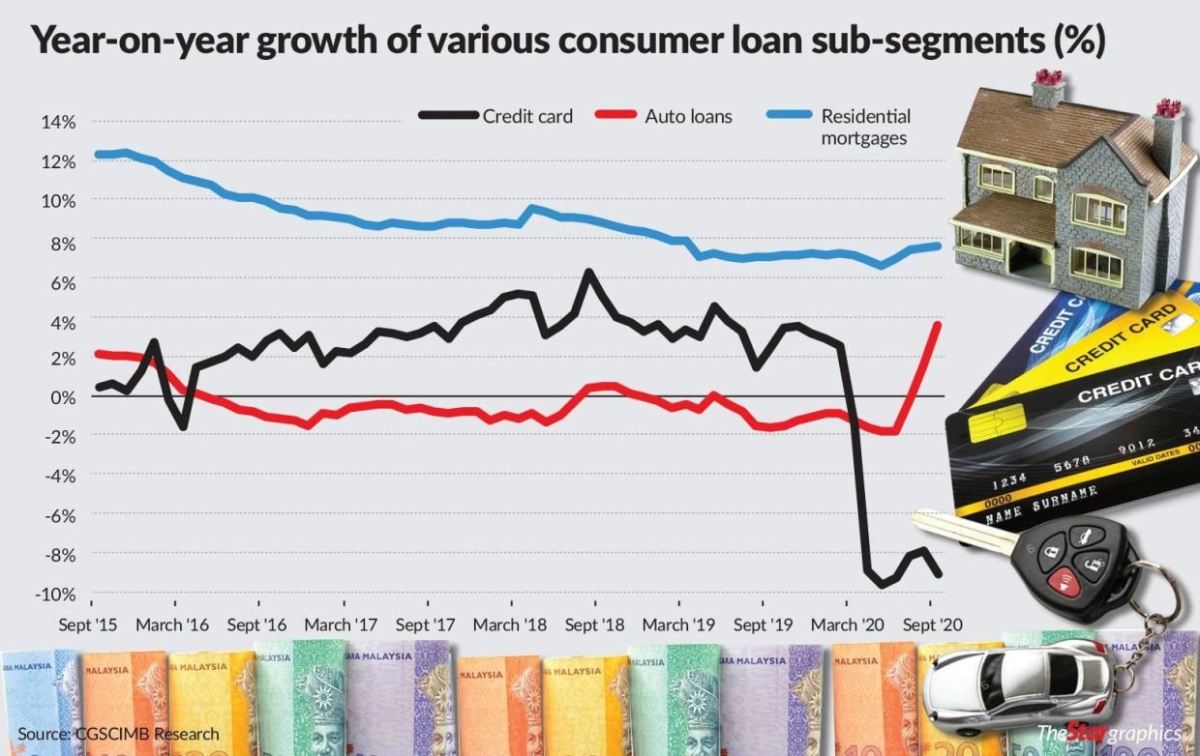

According to CGS-CIMB Equities Research, the auto loan segment was the key driver of household loans growth, with an acceleration from 1.5% yoy at end-August to 3.6% at end-September this year, in line with robust auto sales spurred by the exemption of sales tax.

Auto loan growth in September marked the strongest recorded since October 2014.

“The momentum for residential mortgages only inched up from 7.5% y-o-y at end-August to 7.6% y-o-y at end-September.

“On the flip side, the contraction in credit card receivables widened from 7.9% y-o-y at end-August to 9.1% y-o-y to RM36.1bil at end-September, accounting for only 2% of the banking system’s total loans, ” said CGS-CIMB.

Meanwhile, UOB Kay Hian Malaysia Research cautioned that the asset quality of banks has not reflected the impact of Covid-19.

Gross impaired loans (GIL) ratio in September improved to 1.38% as compared to 1.4% in August due to the automatic loan moratorium, which continues to mask the potential Covid-19-induced asset quality stress.

UOB Kay Hian expects a slight pick-up in GIL ratio after September, but noted that the GIL ratio will remain generally benign until the end of the targeted loan moratorium.

As such, banks are expected to continue to frontload their loan loss provision (LLP) for Covid-19 risks in the second half of the year.

CGS-CIMB projects a surge of 86.9% in banks’ LLP in 2020.

It said the higher LLP could pave way for an earnings recovery in 2021, with a projected net profit growth of 14.8% for the banking sector in 2021.

The research house deduced that banks’ LLP will likely increase further in the third quarter of the year, given the wider increase in the industry’s total provision of RM1.86bil during the quarter, as compared to the RM1.63bil in the second quarter of the year.

Additionally, loan loss coverage for the banking industry was up from 98.4% in August to 105.2% in September, marking a record high.

“The above-100% loan loss coverage signifies that banks’ total provisions are able to cover more than the total value of their gross impaired loans, ” said CGS-CIMB.

US 18965

US 18965  GB 12561

GB 12561  CA 10478

CA 10478  AU 8292

AU 8292  IE 6048

IE 6048  BR 2685

BR 2685  SG 1187

SG 1187  NZ 1132

NZ 1132